Blog

Shifting Dynamics: The Rising Importance

of the Automotive Aftermarket vs. OEM

The automotive industry is in the middle of a major transformation: the Independent Aftermarket (IAM) is steadily gaining ground against the traditional OEM (Original Equipment Manufacturer) channel.

For businesses across the aftermarket value chain—whether suppliers, distributors, or service providers—this shift brings both opportunities and challenges.

The question is: how can companies sharpen their competitive edge in the IAM? And where can modern software solutions make the difference in driving growth and efficiency?

OEM vs. IAM: A Shifting Market

The study “Competitiveness in the Automotive Aftermarket in the Context of the Technology Shift” by Berylls (AlixPartners) makes two points very clear:

- OEMs still enjoy strategic advantages thanks to exclusive data access and software control.

- However, by 2035, the IAM is projected to grow its market share to 67%, while the OEM share is expected to decline to 33%.

Key drivers of this shift include:

| Driver | Impact |

|---|---|

| Aging Vehicle Fleets | Cars are being kept longer, increasingly serviced outside of warranty—leading them to the IAM. |

| Digitalization & E-commerce | Online platforms increase pricing transparency and make parts more accessible. |

| Consolidation & Margin Pressure | Large distributors are merging to remain competitive. |

| BEV/SDV Trends | While EVs reduce maintenance costs, they create new service opportunities for IAM players. |

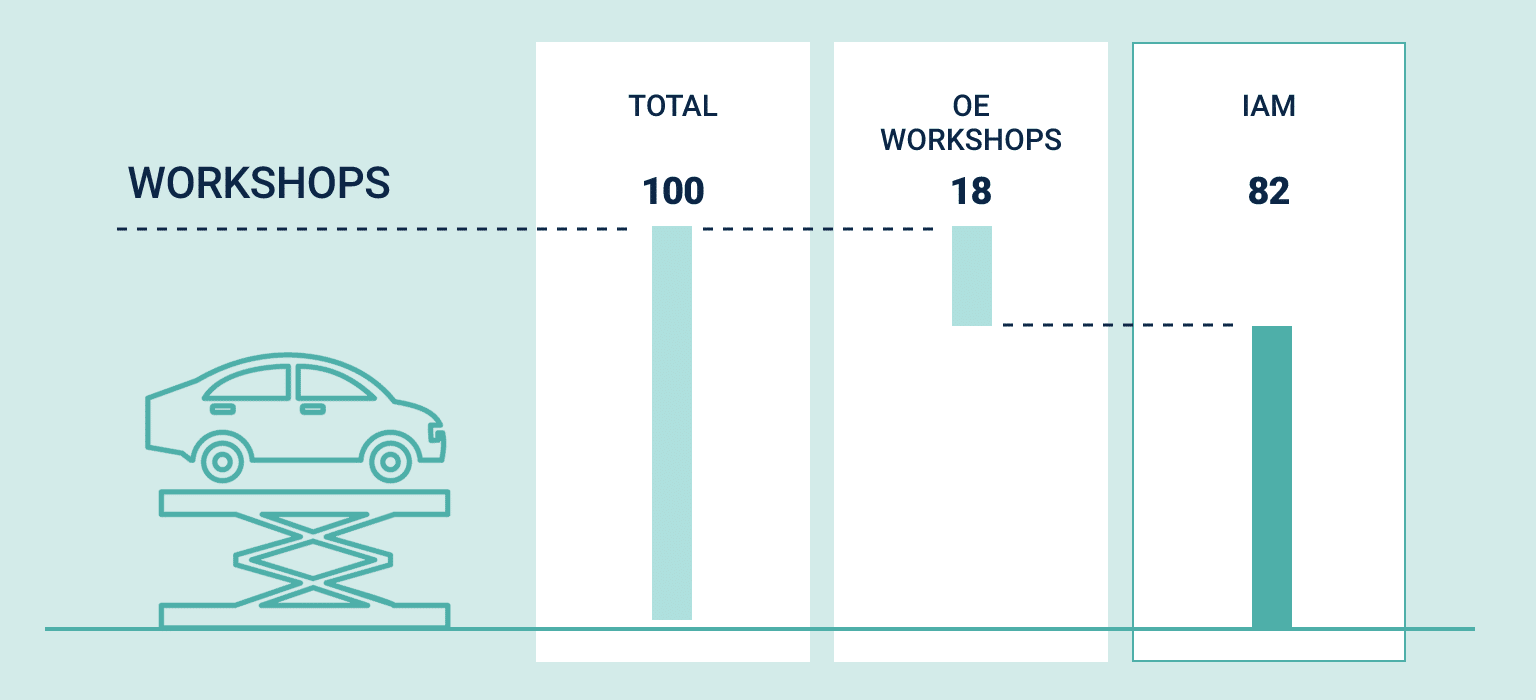

The European Independent Automotive Aftermarket Panorama report by Roland Berger and FIGIEFA (Oct. 2024) underscores how independent workshops now represent more than 80% of aftermarket outlets.

The IAM’s significance is undeniable. Yet with its growing opportunities come equally significant challenges.

Challenges & Opportunities in the IAM

OEMs are working hard to defend their dominant position. While they rely on proprietary platforms and closed ecosystems, the IAM must stand out through innovation, agility, and customer proximity.

Key challenges include:

- Access to vehicle data & software:OEMs still control critical technical information and interfaces (OBD, software updates), putting IAM players at a disadvantage.

- Fragmentation & complexity: A growing variety of brands, models, and part numbers makes product data management increasingly difficult.

- Rising customer expectations: Clients expect fast, reliable, and transparent part availability—online and offline.

- The rise of battery-electric vehicles (BEVs):EV adoption is accelerating, reshaping aftermarket revenue streams.

According to Berylls, the share of BEVs in Europe’s vehicle fleet will increase from 3% in 2024 to 20% in 2035.

At the same time, average aftermarket revenues per vehicle will decline, driven by:

- The elimination of classic wear parts (e.g., oil filters, spark plugs, exhaust systems)

- Fewer required maintenance intervals

- Reduced mechanical repairs

But new opportunities are emerging:

| New Opportunity | Example |

|---|---|

| Battery & Thermal Management | Diagnostics, cooling, replacements |

| Software Services | Updates, error analysis, ECU programming |

| Sensor & ADAS Calibration | Post-accident calibration, ADAS servicing |

| Remote Diagnostics & Predictive Maintenance | Platform-based analysis, vehicle interface management |

The workshop of the future will no longer be defined solely by mechanics—it will be digital, data-driven, and software-enabled.

Roland Berger’s report outlines the IAM ecosystem in four key pillars:

| Pillar | Description |

|---|---|

| 1. Manufacturers (IAM Parts Producers) | Produce non-OEM parts, increasing competition |

| 2. Parts Wholesalers | Act as intermediaries—logistics, assortment management, and consulting |

| 3. Independent Workshops / Workshop Chains | Provide brand-independent repair & maintenance—now heavily digitalized |

| 4. Intermediaries (Insurance, Platforms, Fleets) | New market players shaping sales channels and customer touchpoints |

This broad and agile structure stands in sharp contrast to the OEM-centered model.

AutomotivePIM: The Data Foundation for IAM Success

One thing is certain: a solid data foundation is essential. Only businesses with full control over their product data can deliver efficiency, speed, and flexibility.

That’s why Product Information Management (PIM) has become a strategic success factor in the aftermarket.

AutomotivePIM by Bertsch Innovation is purpose-built for the IAM, providing exactly the capabilities needed:

| Challenge | AutomotivePIM Solution |

|---|---|

| Multiple part variants, manufacturer data & references | Centralized, structured data management with variant logic |

| Diverse data standards (TecDoc, VDA, ACES/PIES) | Native support for industry-specific classifications. The optimized data model enables easy and consistent management of all data standards. |

| Speed in parts trading | Real-time synchronization with e-commerce & ERP systems |

| Globalization & localization | Multilingual, media-neutral data delivery |

| Plattformintegration (z. B. TecCom, Autodoc) | Automated data transfer via API or export |

The IAM as Innovation Driver

While OEMs operate in closed-system environments, the IAM must be more innovative, more flexible, and more open to new market dynamics—whether it’s EV adoption, fleet services, or digital sales platforms.

To scale in this environment, businesses need a reliable, automated, and accurate data foundation—exactly what AutomotivePIM delivers.

Conclusion: Winning With Structured Data in a Disruptive Market

With AutomotivePIM by Bertsch Innovation, aftermarket players gain more than just product data management. They get a powerful platform that streamlines daily operations while building the foundation for a resilient, future-proof value chain.

The IAM is on the rise. To capture its full potential, businesses need the right data strategy. AutomotivePIM is the key to turning data into growth.

Sources:

– Berylls by AlixPartners “Competitiveness in the Automotive aftermarket in the context of the technology Shift”, Sept. 2024

– Roland Berger/FIGIEFA “European Independent Automotive Aftermarket Panorama”, Oct. 2024

Highlighted Whitepaper

ePaper: Automotive Aftermarket

Download onze automotive aftermarket e-paper en kom meer te weten over de dagelijkse uitdagingen van fabrikanten, werkplaatsen en serviceproviders.